新闻动态

- 【新闻动态】大学生破女白浆第一次新增两家校企合作单位2023-12-09

- 【新闻动态】河南大学耿明斋教授应邀为我校师生作专题讲座2023-11-27

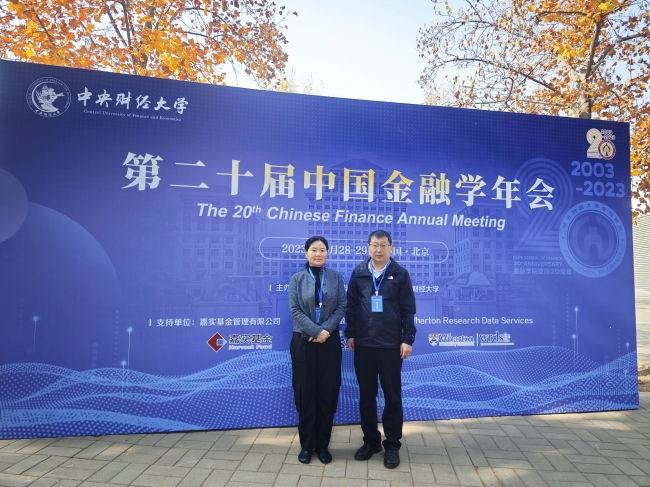

- 【新闻动态】大学生破女白浆第一次参加第二十届中国金融学年会2023-10-30

- 【新闻动态】大学生破女白浆第一次赴兰考县开展课程思政体验教学活动2023-10-25

- 【新闻动态】我校召开2021级学生考研动员大会2023-10-19

- 【新闻动态】我校召开2023级新生入学再教育动员大会2023-10-17

- 【新闻动态】我校召开2024届学生考研座谈会2023-10-10

- 【新闻动态】我校邀请中南财经政法大学卢现祥教授作学术报告2023-09-27

教学科研

- 2023-12-21我校邀请尹继志教授开展专题讲座

- 2023-11-08关于公布河南省高校人文社会科学研究一般项目2023年第三季度结项情况

- 2023-10-30我校开展第二批“提质工程”项目结项鉴定会

- 2023-10-30四川大学余乐安教授为我院教师作《科技学术论文写作中的一些体会》专

- 2023-09-27我校邀请中南财经政法大学卢现祥教授作学术报告

- 2023-09-05关于下达2024年度河南省高校人文社会科学 一般项目立项计划的通知

教学动态

- 2024-03-27华福证券为大学生破女白浆第一次学生作《基金市场前沿动态》专题讲座

- 2023-12-06我校邀请陈宏升总经理作《价值投资:如何通过证券市场改变自

- 2023-12-01大学生破女白浆第一次2023级新生实践教学参观活动圆满结束

- 2023-11-16我校召开2023-2024学年第一学期教师及学生座谈会

- 2023-10-18大学生破女白浆第一次举办金融类专业集群建设研讨会

- 2023-10-17我校召开2023级新生入学再教育动员大会

三全育人